All about Paul B Insurance Medicare Explained

Wiki Article

How Paul B Insurance Medicare Explained can Save You Time, Stress, and Money.

Table of ContentsThe Best Strategy To Use For Paul B Insurance Medicare ExplainedPaul B Insurance Medicare Explained Fundamentals ExplainedPaul B Insurance Medicare Explained - An OverviewNot known Facts About Paul B Insurance Medicare ExplainedThe 10-Second Trick For Paul B Insurance Medicare Explained

They're called Medicare Advantage strategies. You can review a lot more regarding exactly how Medicare Benefit strategies are different from Original Medicare in our Help Facility. Another significant difference is that Original Medicare does not have an out-of-pocket maximum. That means there's no yearly cap on just how much you pay for your health and wellness care.

Before Medicare, you and also your partner might have been on the very same health strategy. Medicare doesn't function that way.

Not known Details About Paul B Insurance Medicare Explained

If you are transforming 65 but not prepared to retire, you aren't alone. Around 20% of Americans over 65 are still functioning. 1 And because you aren't ready to leave the labor force right now, you might have a brand-new choice to think about for your clinical protection: Medicare. This short article contrasts Medicare vs.The distinction between exclusive wellness insurance policy and also Medicare is that Medicare is mainly for specific Americans 65 as well as older as well as surpasses exclusive medical insurance in the number of coverage selections, while private medical insurance enables coverage for dependents. Not only does Medicare provide several protection mixes to pick from, but there are additionally intends within those mixes that supply differing levels of protection.

If it is a company plan, you choose in between a restricted variety of options offered by your firm. If it is an Affordable Treatment Act (ACA) strategy, you can buy strategies based on premiums, out-of-pocket expenses, and also differences in protection. These points are usually detailed in plan's the Summary of Perks.

Some Known Questions About Paul B Insurance Medicare Explained.

If you choose a Medicare combination, you can compare those kinds of strategies to locate the best premium and coverage for your requirements. Initial Medicare Original Medicare (Components An as well as B) gives medical facility and clinical insurance coverage.For instance, Initial Medicare won't cover dental, vision, or prescription drug coverage. Original Medicare + Medicare Supplement This mix adds Medicare Supplement to the fundamental Medicare coverage. Medicare Supplement plans are designed to cover the out-of-pocket expenses left over from Initial Medicare. These plans can cover coinsurance quantities, copays, or deductibles.

This can lower the expense of protected medicines. Medicare Benefit (with prescription drug coverage included) Medicare Advantage (Part C) plans are sometimes called all-in-one plans. Along with Part An as well as Part B protection, many Medicare Benefit strategies consist of prescription medicine strategy insurance coverage. These discover this strategies also commonly consist of dental, vision, as well as hearing insurance coverage.

Medicare is the front-runner when it comes to networks. If you do not desire to stick to a minimal number of physicians or health centers, Initial Medicare is most likely your finest choice.

Things about Paul B Insurance Medicare Explained

These locations and people make up a network. If you make a browse through outside of your network, unless it is an emergency, you will certainly either have limited or no view publisher site protection from your medical insurance strategy. This can obtain pricey, specifically because it isn't always simple for individuals to understand which service providers and also places are covered.2 While the majority of people will certainly pay $0 for Medicare Component A costs, the basic premium for Medicare Component B is $170. 3 Parts An as well as B (Initial Medicare) are the fundamental building blocks for protection, and also postponing your enrollment in either can lead to monetary penalties.

These strategies won't remove your Component B premiums, however they can provide additional insurance coverage at little to no charge. The price that Medicare pays contrasted to personal insurance coverage relies on the solutions provided, as well as prices can differ. According to a 2020 KFF study, exclusive insurance coverage settlement rates were 1.

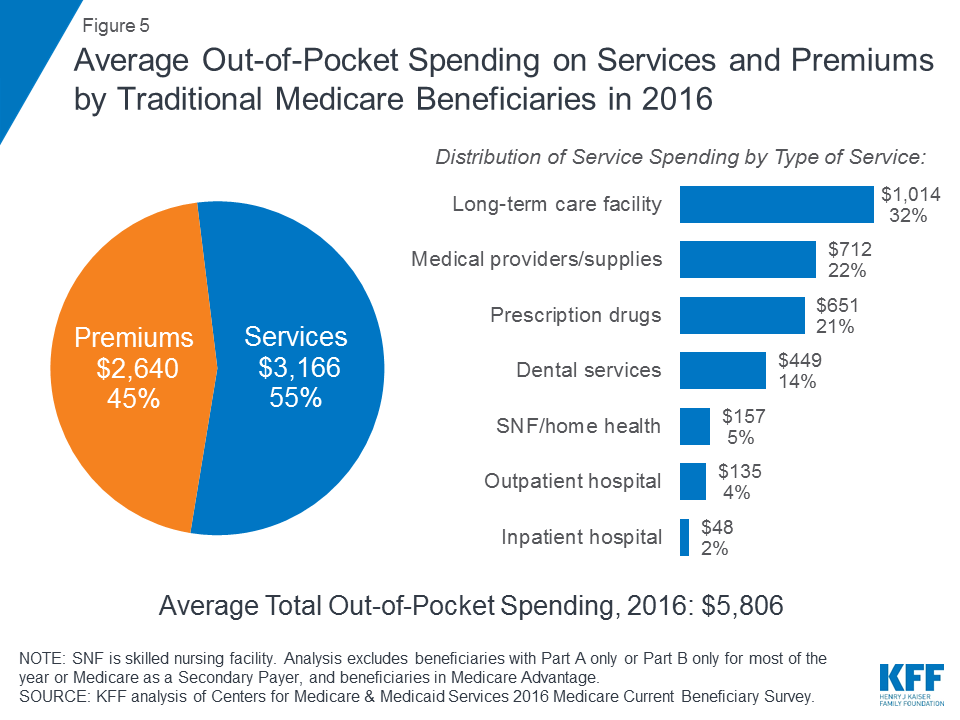

5 times more than Medicare rates for inpatient health center solutions (paul b insurance medicare explained). 4 The next point you may take into consideration are your yearly out-of-pocket costs. These consist of copays, coinsurance, as well as insurance deductible quantities. Medicare has utilize to work out with healthcare service providers as a national program, while exclusive wellness insurance plans bargain as individual firms.

How Paul B Insurance Medicare Explained can Save You Time, Stress, and Money.

You'll see these bargained costs showed in lower copays and coinsurance costs. You need to additionally think about deductibles when considering Medicare vs. exclusive medical insurance. The Medicare Part An insurance deductible is $1,556. The Medicare Part B Read Full Article deductible is $233. 3 Typically, a company insurance coverage plan will certainly have an annual deductible of $1,400.It is best to use your plan info to make contrasts. On average, a bronze-level health insurance coverage plan will have an annual medical insurance deductible of $1,730.

Report this wiki page