Travel Insurance for Dummies

Wiki Article

Rumored Buzz on Renters Insurance

Table of ContentsLife Insurance Things To Know Before You Get ThisSome Known Questions About Medicaid.Insurance Things To Know Before You Get ThisA Biased View of Insurance

You Might Want Disability Insurance Coverage Too "Unlike what many individuals believe, their residence or vehicle is not their biggest property. Rather, it is their capacity to gain an income. Lots of specialists do not guarantee the possibility of an impairment," stated John Barnes, CFP as well as owner of My Household Life Insurance Coverage, in an email to The Balance.

The info below concentrates on life insurance offered to people. Term Term Insurance is the most basic form of life insurance coverage.

The price per $1,000 of benefit boosts as the insured individual ages, and it obviously gets really high when the insured lives to 80 and also beyond. The insurance policy company could bill a costs that enhances each year, but that would make it extremely hard for many people to manage life insurance policy at sophisticated ages.

Some Known Facts About Home Insurance.

Insurance coverage are created on the concept that although we can not stop unfavorable events occurring, we can safeguard ourselves financially versus them. There are a huge number of various insurance coverage offered on the marketplace, and all insurance companies try to encourage us of the qualities of their specific product. So a lot to make sure that it can be tough to decide which insurance coverage plans are really essential, as well as which ones we can realistically live without.Scientists have found that if the key wage earner were to die their family would just have the ability to cover their family costs for simply a couple of months; one in 4 households would have issues covering their outgoings promptly. Most insurers suggest that you take out cover for around 10 times your annual earnings - health insurance.

You ought to additionally factor in childcare costs, and also future university costs if suitable. There are two primary sorts of life insurance plan to select from: whole life policies, and also term life policies. You pay for entire life policies till you die, and you pay for term life policies for a collection time period figured out when you obtain the policy.

Health And Wellness Insurance coverage, Health insurance coverage is another one of the four primary kinds of insurance policy that experts advise. A current study revealed that sixty two percent of personal bankruptcies in the US in 2007 were as a direct result of health issue. An unexpected seventy 8 percent of these filers had medical insurance when their health problem began.

The Basic Principles Of Renters Insurance

Premiums differ significantly according to your age, your current state of wellness, and also your lifestyle. Even if it is not a lawful need to take out auto insurance coverage where you live it is highly recommended that you have some kind of policy in area as you will still have to assume monetary duty in the case of a mishap.Furthermore, your automobile is frequently one of your most useful properties, and if it is damaged in an accident you may battle to pay for fixings, or for a replacement. You might likewise discover yourself responsible for injuries sustained by your passengers, or the vehicle driver of another vehicle, hop over to here and for damages created to an additional vehicle as a result of this link your carelessness.

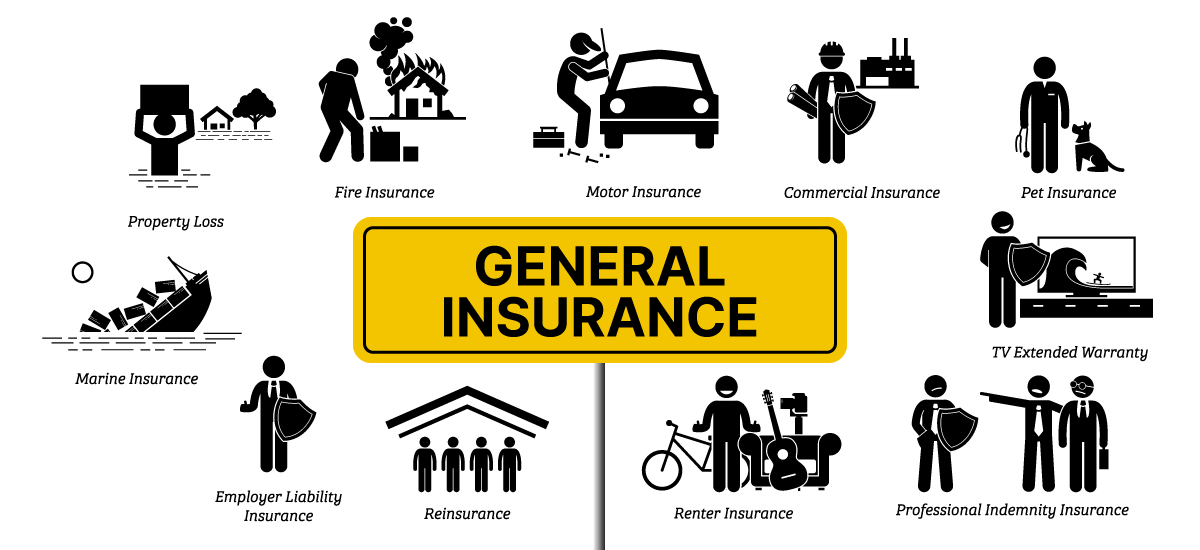

General insurance policy covers house, your traveling, vehicle, as well as health (non-life properties) from fire, floodings, accidents, man-made catastrophes, and theft. Different kinds of basic insurance include electric motor insurance policy, health insurance policy, traveling insurance, and also house insurance coverage. A general insurance plan spends for the losses that are sustained by the insured during the period of the policy.

Continue reading to recognize more regarding them: As the residence is an important possession, it is essential to safeguard your house with a correct. Home as well as family insurance coverage safeguard your residence as well as the items in it. A home insurance policy essentially covers manufactured and all-natural scenarios that may lead to damage or loss.

About Cheap Car Insurance

When your lorry is accountable for an accident, third-party insurance policy takes treatment of the injury triggered to a third-party. It is also vital to note that third-party electric motor insurance is obligatory as per the Electric Motor Automobiles Act, 1988.

When it comes to wellness insurance policy, one can opt for a standalone health and wellness plan or a family floater strategy that supplies coverage for all family participants. Life insurance supplies coverage for your life.

Life insurance coverage is different from general insurance on various specifications: is a temporary agreement whereas life insurance policy is a lasting agreement. In the case of life insurance coverage, the benefits as well as the sum guaranteed is paid on the maturity of the policy or in the occasion of the policy holder's fatality.

They are nonetheless not required to have. The basic insurance cover that is required Discover More Here is third-party obligation car insurance coverage. This is the minimum protection that an automobile must have before they can ply on Indian roadways. Every single kind of general insurance coverage cover includes a goal, to use protection for a particular aspect.

Report this wiki page